Going digital is the strategy every business must follow to reach the new generation of consumers. Customers prefer online shopping because of its accessibility and satisfactory results. As consumers become increasingly reliant on digital payments, the role of traditional payment processors becomes less relevant. Businesses must provide a comprehensive range of payment methods to remain competitive in this ever-changing landscape.

According to a report from Forrester Research, contactless payment penetration in the US reached 30% of digital payment volume in 2016. For some industries, contactless penetration is over 50%, with younger shoppers (aged 18–24) driving the trend. This tells us that small business owners can’t afford their businesses to be offline.

Businesses Can’t Afford To Be Offline, and here is why:

- The Decline of Cash: Cash transactions are on the decline as consumers embrace the convenience of digital payments. From mobile wallets to contactless payments, customers expect businesses to provide flexible payment options that align with their preferences. By offering multiple payment methods, you cater to a broader customer base and create a seamless buying experience.

- High Credit Card Processing Fees: Traditional credit card processing fees can eat into your profits, especially for small businesses. These fees can be a significant burden, limiting your ability to invest in other business areas. By diversifying your payment methods, you can reduce your reliance on credit cards and minimize the impact of high processing fees.

- Adapting to Future Trends: The payment landscape constantly evolves, with new technologies and trends emerging regularly. By partnering with Kade Pay, you ensure your business remains adaptable to these changes. Our platform is designed to stay ahead of the curve, enabling you to accept emerging payment methods such as cryptocurrencies or other innovative solutions.

Kade Pay – Your Gateway to Accepting Multiple Payment Methods:

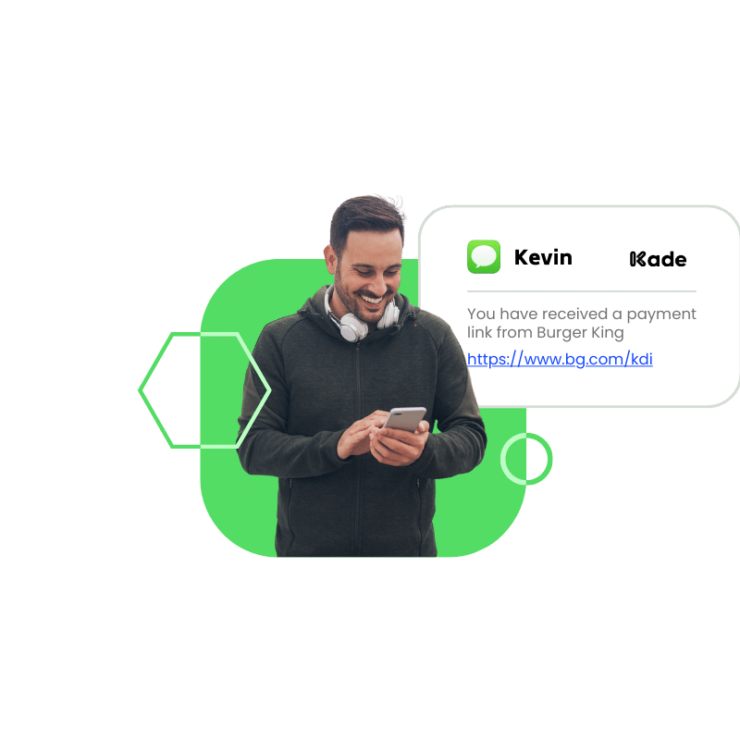

With Kade Pay, you can have the power to accept various payment methods. Our platform allows you to seamlessly process mobile payments, accept contactless payments, and offer online payment options. By providing these choices, you empower your customers to pay how they prefer, increasing customer satisfaction and loyalty.

By diversifying your payment options, you enhance the customer experience, reduce the impact of high credit card processing fees, and future-proof your business. Join forces with Kade Pay to embrace the future of payments and unlock the full potential of your business.

Remember, adaptability is the key to success in an ever-changing business landscape, and Kade Pay is here to support you every step of the way.

Sign up with Kade Pay today and transform how you accept payments.